Tesla’s profit drop has raised significant concerns among investors and analysts alike, as the electric vehicle giant reported a staggering 71% decrease in profits for the first quarter. This downturn, amounting to only $409 million, comes amidst a string of challenges, including looming tariffs and controversies surrounding CEO Elon Musk’s political affiliations. The recent Tesla earnings report revealed earnings per share of 27 cents, far beneath the expected 41 cents, showcasing the company’s struggle in the competitive electric vehicle market. To make matters worse, Tesla stock has declined nearly 40% this year, driven by automotive sales challenges and heightened competition. As market dynamics shift, many are questioning whether Tesla can regain its footing and stabilize its diminishing profits in an increasingly volatile landscape.

The recent downturn in Tesla’s financial performance highlights a worrisome trend for the company, subject to scrutiny from investors and industry experts. As the electric car manufacturer grapples with diminishing profit margins, with reports indicating a significant drop in earnings, the ramifications have echoed throughout the automotive business and beyond. Challenges related to Musk’s controversies and the broader electric vehicle marketplace have intensified, pushing Tesla’s stock prices down sharply. Amid the hurdles of automotive sales and aggressive market competition, the question remains whether Musk can navigate these obstacles effectively. This critical juncture for the company underscores the need for strategic moves to bolster investor confidence and stabilize its rapidly fluctuating stock.

Tesla Profit Drop: Analyzing the Economic Fallout

Tesla has recently experienced a staggering profit drop, reporting a 71% decrease in profits for the first quarter of the year. This decline is attributed to a mix of internal and external challenges, including rising tariffs imposed by the Trump administration and growing competition within the electric vehicle (EV) landscape. Analysts had anticipated earnings per share to be around 41 cents, but the actual results of 27 cents fell well short of those expectations, raising concerns over Tesla’s operational efficiency and overall market strategy. The decrease in revenue—down 9% year over year to $19.3 billion—further illustrates the broader challenges facing the company as it navigates a tumultuous economic environment.

In light of these figures, Tesla’s stock has also faced significant pressure, falling nearly 40% this year. Investors are reevaluating their positions as the company grapples with automotive sales challenges that seem to be exacerbated by CEO Elon Musk’s controversial decisions. The interplay between Musk’s public persona and Tesla’s financial health can’t be overlooked. As the brand continues to grapple with its public image while racing against competitors, it remains to be seen whether they can rebound from this profit drop.

The strain on profits has not only affected Tesla’s financial standing but also investor confidence. With such significant profit declines, analysts are closely watching Tesla’s ability to adapt to market dynamics. The company has relied heavily on its innovative image; however, recent controversies surrounding Musk’s political ties are raising red flags for stakeholders. As Tesla tries to reposition itself in a rapidly evolving electric vehicle market, it must prove its resilience and capability to weather economic storms.

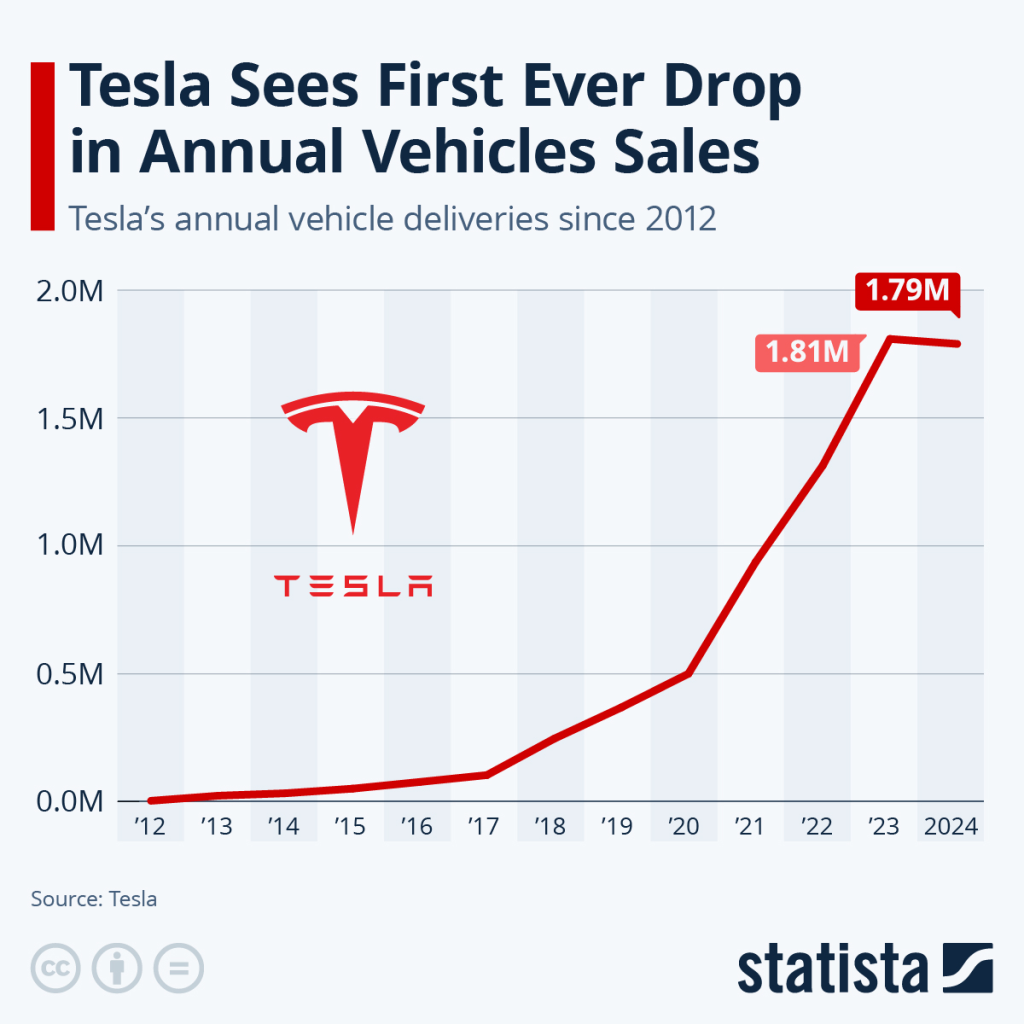

As Tesla considers cost-cutting measures, including halting imports from China, the company needs to strike a balance between maintaining its competitive edge and ensuring profitability. The recent decline in deliveries, with a 13% year-over-year drop, highlights the pressing need for effective management strategies to overcome these turbulent financial hurdles. Looking ahead, how Tesla navigates this profit drop and the accompanying challenges will be critical in determining its long-term success.

Impacts of Elon Musk’s Controversies on Tesla’s Shares

Elon Musk’s involvement in various controversies has had profound repercussions on Tesla’s stock performance. With his polarizing public persona and high-profile political affiliations, many investors are questioning whether Musk’s actions are tarnishing the Tesla brand. Recent protests and boycotts have exacerbated the situation, reflecting a shift in public perception among Tesla drivers and raising significant concerns about resale values. As reported, the brand has suffered substantial losses in terms of year-over-year resale value, suggesting that customer loyalty may be wavering due to Musk’s controversial status.

With analysts like Dan Ives emphasizing Musk’s need to reassert commitment to the company, the anticipation grows around Tesla’s representation in the marketplace. Any further dip in share prices may compel investors to seek alternatives as Tesla faces stiff competition from other automakers entering the electric vehicle sector. To mitigate concerns, Tesla will need to reestablish its image as the pioneer in innovative automotive technology rather than a politically-driven entity.

Critics note that Tesla’s lifting of tariffs could be critical for smoothing out financial turbulence in the upcoming quarters. However, the ongoing controversies surrounding Musk hinder efforts to stabilize not just the share price but overall market confidence in the brand. Investors want to perceive Tesla as a leader in the EV market, and they need communication and actions from Musk that reaffirm commitment to the core values of innovation and sustainability. Any misstep in this regard could lead to further declines in Tesla’s stock, tying directly back to Musk’s actions and statements, which appear to steer the narrative surrounding the company.

Challenges in the Electric Vehicle Market: Tesla’s Position

As an industry leader in the electric vehicle sector, Tesla finds itself navigating a landscape full of challenges that are affecting overall automotive sales. The influx of competitors has intensified the race for market share, making it essential for Tesla to maintain a unique value proposition. Traditional automotive manufacturers are ramping up their efforts to develop electric vehicles, which threatens Tesla’s dominance. The company’s challenges are compounded by rising material costs and tariffs that impact profitability and pricing strategies.

While Tesla has been at the forefront of EV innovation, the company is now faced with the necessity to continually improve its offerings while managing production challenges. The recent profit drop signals a critical juncture for Tesla, as it must articulate a clear vision that resonates with consumers who are increasingly seeking reliability and value. The future of Tesla as a market leader hinges on its ability to effectively address these burgeoning automotive sales challenges while leveraging its first-mover advantage.

Tesla’s strategy will need to focus on sustainability and the unique benefits that electric vehicles provide. This includes highlighting advancements in battery technology, autonomous driving capabilities, and environmental impact reduction. Additionally, fostering strong alliances with suppliers can help mitigate challenges posed by tariffs and ensure a steady flow of necessary components. Maintaining a prominent presence in the public eye, devoid of controversies, will also be essential for instilling investor and consumer confidence as Tesla struggles to navigate through these market challenges.

Assessing the Tesla Stock Decline: Implications for Investors

Tesla’s stock has taken a significant hit this year, with a near 40% decline that has sparked concern among investors. The factors contributing to this drop are multifaceted, including financial performance, declining revenue, and external pressures such as tariffs and competition. The ongoing assessment of Tesla’s performance by analysts plays a crucial role in shaping investor sentiment, as modifications to price targets can create waves in the stock market. With a revised target of $315, analysts urge caution while navigating the volatility surrounding Tesla’s shares.

Investors must carefully examine not just the current state of Tesla’s financial health but also the broader implications of market trends. As other players in the electric vehicle sector ramp up their operations, Tesla’s ability to maintain an edge relies on innovation and adapting to evolving consumer preferences. As this stock decline continues, careful market observation and strategic investment decisions will be critical to navigating the challenges ahead.

For investors, understanding the fluctuation of Tesla’s stock involves both short-term dynamics and long-term considerations. As Elon Musk continues to steer the brand’s direction, the relationship between his controversies and Tesla’s stock performance cannot be underestimated. The pressures of declining profits and rising competition combined with external factors such as government policies play a significant role in shaping Tesla’s market narrative. Investors who remain vigilant and informed about these elements may better position themselves to either capitalize on opportunities or mitigate risks associated with Tesla’s ongoing stock decline.

Electric Vehicle Market Trends: The Future After Tesla

The electric vehicle market is evolving at a rapid pace, presenting both challenges and opportunities for established companies like Tesla. As new entrants emerge, fueled by advancements in technology and changing consumer preferences, it becomes apparent that Tesla cannot rest on its laurels. Despite being a pioneer in the EV sector, the landscape now demands relentless innovation and strategic agility. With environmental regulations becoming increasingly stringent, the demand for electric vehicles is expected to surge, emphasizing the need for competitive pricing and superior functionalities among manufacturers.

Tesla’s position in this evolving landscape will depend on its ability to adapt to these market trends. Investing in research and development to enhance battery technology and reduce manufacturing costs will be vital in maintaining its market share. As other manufacturers catch up, Tesla must leverage its first-mover advantage while rebranding to shed any negative connotations tied to recent controversies, ensuring they remain perceived as a leader in sustainable transportation.

Moreover, as the consumer base expands towards eco-conscious buyers and tech-savvy individuals seeking advanced features, Tesla’s marketing strategies must also evolve. Highlighting the unique selling propositions of Tesla vehicles, including their sustainability and innovative technology, will help align the brand with evolving consumer values. As the electric vehicle market continues to change, companies, including Tesla, must foster a proactive stance to outpace competitors and capitalize on emerging trends. Tesla’s future will be contingent on agile responses to consumer demands and a redefined corporate narrative that emphasizes its commitment to electric mobility.

Navigating Tariff Challenges: Tesla’s Strategic Response

Tariff challenges present significant hurdles for Tesla, impacting operational costs and supply chain efficiency. The recent imposition of a 25% tax on vehicle imports poses a considerable risk to Tesla’s competitive positioning within the electric vehicle market. To mitigate the effects of these tariffs, Tesla has proactively suspended imports of critical auto parts from China and may need to reevaluate its sourcing strategies to avoid further financial strain. This measure signals the urgency for Tesla to reassess its dependency on international suppliers while exploring domestic sourcing options to remain resilient in this increasingly volatile economic environment.

By strategically adjusting its supply chain to insulate against tariff implications, Tesla can enhance its operational efficiency and ensure a steady production line. Furthermore, understanding the regulatory landscape will be essential for aligning business decisions with governmental policies. Efforts to innovate local manufacturing capabilities may also help position Tesla favorably amid tariff-induced market pressures, reinforcing its stature as a leader in the electric vehicle sector.

In facing these tariff challenges, Tesla can further develop its infrastructure by building localized production facilities. This move would not only reduce reliance on foreign imports, ensuring that production meets demand without excessive tariffs but could also foster community support and strengthen brand loyalty. As Tesla strives to maintain its reputation, addressing these challenges directly will be crucial to sustaining investor confidence and market competitiveness. The company’s responsiveness to geopolitical shifts will determine its business resilience and ability to adapt to the ever-changing landscape of the automotive industry.

Forecasting Tesla’s Future Performance Amidst Industry Shifts

As the electric vehicle landscape shifts, forecasting Tesla’s future performance becomes a complex endeavor. Key factors such as competition, regulatory pressures, and consumer perception will be instrumental in shaping the company’s trajectory. With traditional automakers investing heavily in their electric vehicle offerings, Tesla’s ability to innovate will be paramount. Increasingly, consumers are prioritizing sustainability and technological advancements—not just brand prestige—thus signaling a crucial pivot for Tesla.

Moreover, the recent controversy surrounding Elon Musk has further complicated market forecasts. As consumer sentiment shifts away from brands perceived as politically charged, Tesla might need to recalibrate its marketing strategy to regain goodwill among its customer base. Building a narrative centered around technological innovation, environmental impact, and community engagement will be essential for recapturing market momentum.

Looking forward, Tesla’s performance will hinge on its adaptability to industry dynamics and responsiveness to emerging consumer needs. Monitoring market behavior and making data-driven decisions will enhance Tesla’s ability to foresee shifts and act accordingly. By reinforcing commitment to electric innovation while minimizing the impact of current challenges, Tesla can chart a path toward sustainable growth in a competitive landscape. Ultimately, Tesla’s future will be a reflection of its operational choices and interactions with consumers in an increasingly complex automotive market.

Consumer Sentiment and Its Impact on Tesla’s Brand

Consumer sentiment has a profound impact on Tesla’s brand reputation and market performance. As Tesla faces backlash due to controversies involving CEO Elon Musk, the emotional connection consumers have with the brand becomes paramount. Initial enthusiasm for electric vehicles and admiration for Tesla’s innovation may be waning as customers express dissatisfaction with Musk’s polarizing persona. Recent reports indicate that some long-time supporters of Tesla are reconsidering their allegiance, signifying the brand’s vulnerability to shifting consumer attitudes.

To counteract negative sentiments, Tesla must conscientiously engage with its audience and rebuild trust. Highlighting initiatives related to sustainability, community engagement, and economic inclusion can help mitigate brand perceptions and focus public attention back on Tesla’s technological achievements. Continued engagement and transparent communication regarding operational challenges will also be crucial in sustaining consumer loyalty and enthusiasm for the brand.

Tesla’s marketing strategy must shift to place greater emphasis on the values that define its core consumer base: innovation, sustainability, and social responsibility. Executing campaigns focused on environmental impact and community engagement can resonate strongly with consumers seeking to support brands aligned with their values. This approach not only helps soften the impact of Elon Musk’s controversies but also reinforces Tesla’s commitment to making a positive difference in the automotive industry. The ability to project a positive image will play a vital role in sustaining Tesla’s market performance and upholding its status as a leader within the electric vehicle market.

Frequently Asked Questions

What caused Tesla’s profit drop in the latest earnings report?

Tesla’s profit drop of 71% in the first quarter was primarily attributed to challenges such as impending tariffs, a controversial brand image linked to CEO Elon Musk’s political activities, and a 9% decrease in revenue from the previous year to $19.3 billion.

How did Elon Musk’s controversies affect Tesla’s stock decline?

Elon Musk’s controversies, particularly his involvement with the Trump administration, have negatively impacted Tesla’s brand image, leading to protests and a decline in stock value. The perception of Tesla as a political symbol has embarrassed some customers and contributed to the overall 40% drop in Tesla stock this year.

What are the major challenges affecting Tesla’s automotive sales?

Tesla is facing a variety of automotive sales challenges, including increased competition from other electric vehicle manufacturers, the impact of high tariffs on parts imports, and declining brand reputation due to Elon Musk’s controversies, which have collectively led to a 13% decline in vehicle deliveries.

How did Tesla’s earnings report impact investor confidence?

The disappointing earnings report, which revealed a profit drop and lower-than-expected earnings per share, has significantly shaken investor confidence. Analysts have lowered their price targets for Tesla stock amidst concerns over tariffs, Musk’s political involvement, and falling automotive sales.

What role do tariffs play in Tesla’s profit drop and future production plans?

The 25% tariff on vehicle imports imposed by the Trump administration has contributed to Tesla’s profit drop by increasing production costs. It has also led Tesla to suspend imports of essential auto parts from China, crucial for the production of new vehicles like the Cybercab, potentially jeopardizing future manufacturing plans.

How does Tesla’s recent profit drop affect its standing in the electric vehicle market?

Tesla’s recent profit drop suggests vulnerabilities in its leadership and business strategy, raising concerns about its competitive position in the rapidly growing electric vehicle market, especially as competition intensifies from other manufacturers and consumer sentiment shifts due to Musk’s controversies.

What are analysts saying about Tesla’s future after the recent profit drop?

Analysts have expressed concerns regarding Tesla’s future, suggesting that the recent profit drop and declining stock prices indicate deeper governance challenges. The need for Musk to reestablish credibility and focus on operational issues is critical for regaining investor trust and stabilizing Tesla’s market position.

Will the declining resale value of Tesla vehicles impact future sales?

Yes, the declining resale value of Tesla vehicles, which has seen significant losses year over year, may influence future sales by diminishing consumer confidence and perceived value of the brand, making potential buyers hesitant amid escalating market competition.

| Key Point | Details |

|---|---|

| Profit Decrease | Tesla’s profit fell by 71% in Q1, totaling $409 million. |

| Earnings Per Share | Adjusted earnings per share were 27 cents, below the expected 41 cents. |

| Revenue Drop | Revenue decreased by 9% to $19.3 billion compared to last year. |

| Stock Price Decline | Tesla’s stock has dropped nearly 40% this year. |

| Challenges Face | Facing issues from tariffs and negative brand perception. |

| Future Outlook | Concerns regarding Cybercab production due to halted imports from China. |

| Leadership Concerns | Board treasurers raised issues on Tesla’s governance and leadership challenges. |

Summary

Tesla profit drop has become a significant concern following the company’s staggering 71% decrease in profits reported for the first quarter. The combination of tariff impacts, declining vehicle deliveries, and reputational challenges faced by CEO Elon Musk has created substantial uncertainty for both investors and consumers. Addressing these issues is crucial for Tesla to regain its footing in the competitive electric vehicle market.